Etihad Airways’ IPO could take flight soon

Owner ADQ has appointed more advisors and noise around the transaction is building. Etihad delivered 40% passenger growth last year; Q1 24 datapoints have also been strong. Let's explore further...

Press reports suggest Etihad’s IPO is taxiing for take-off, with owner ADQ appointing more advisors to the transaction

Etihad CEO Neves oversaw Azul’s Brazilian listing in 2017. IATA sees 10% global passenger growth this year

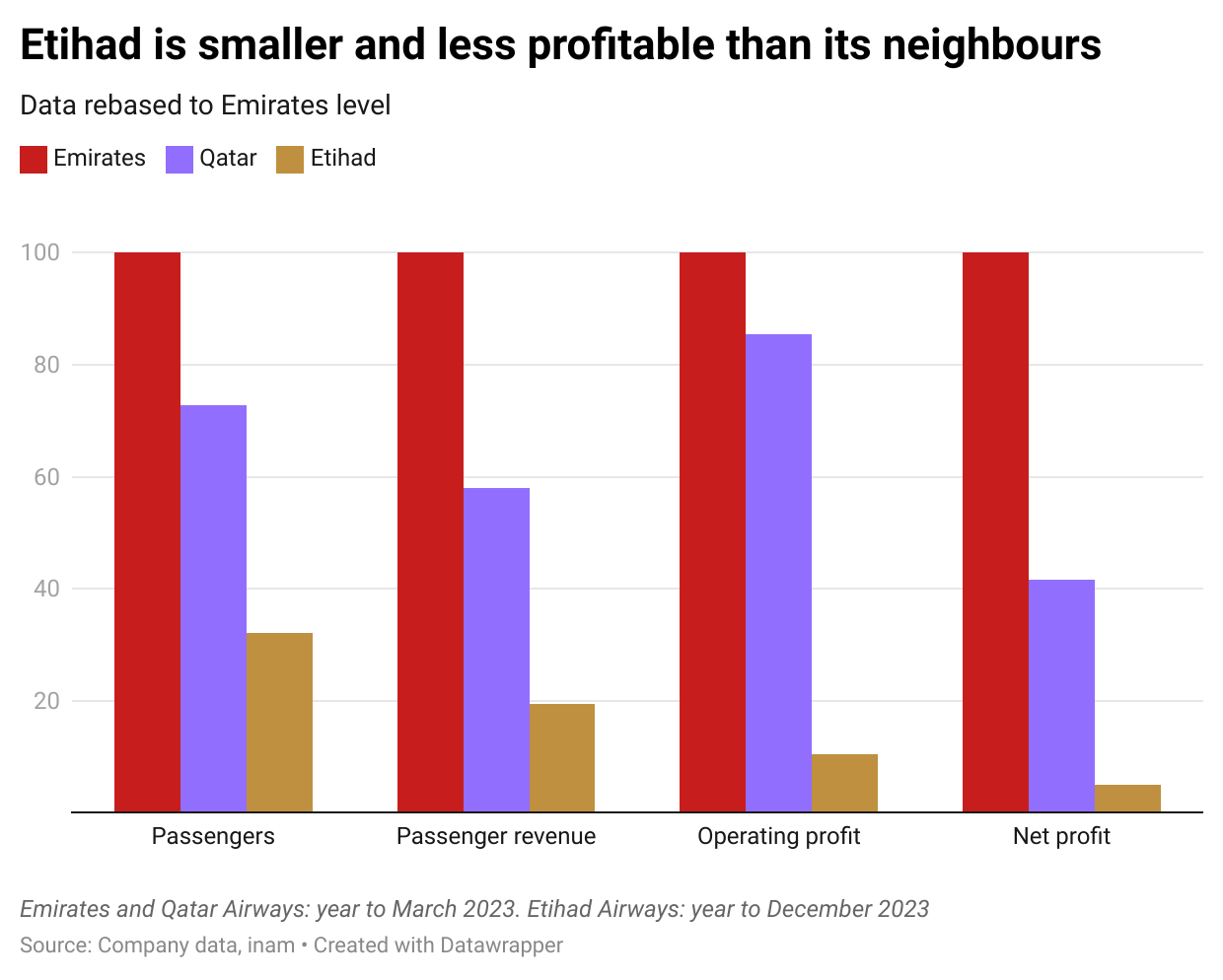

Etihad delivered 40% passenger growth in 2023 but is smaller than neighbours Emirates and Qatar Airways

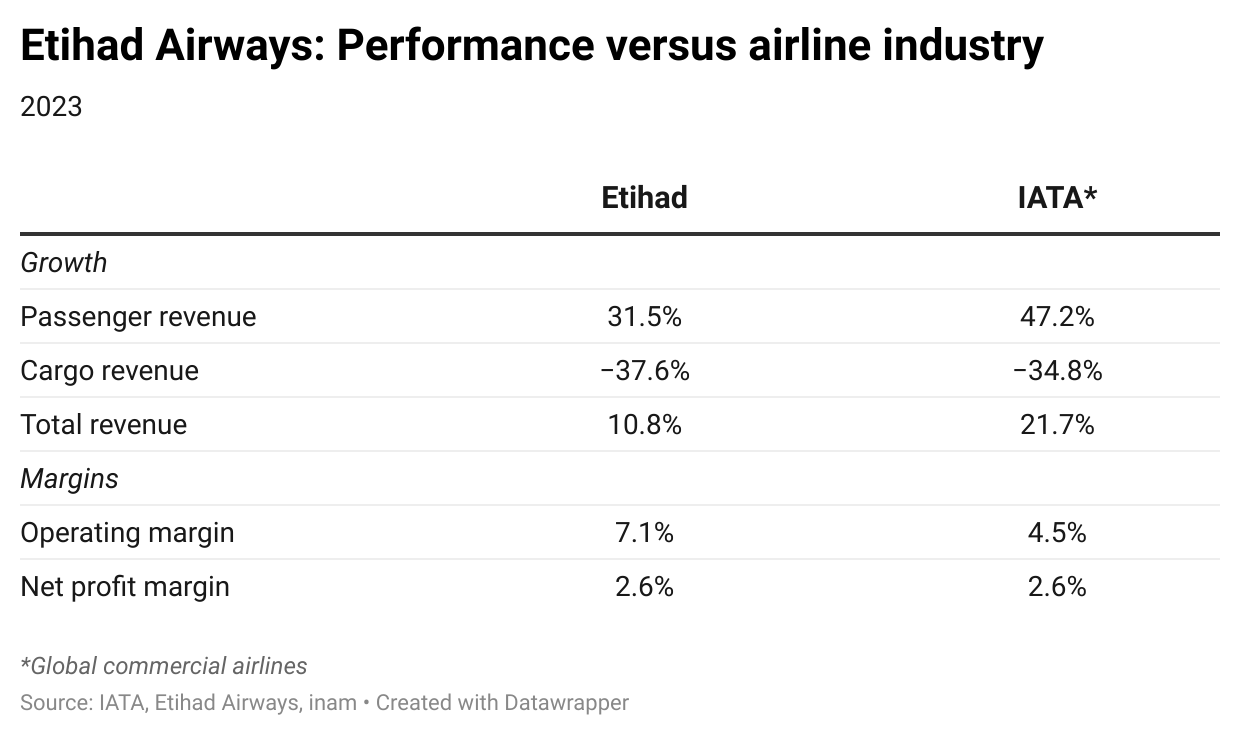

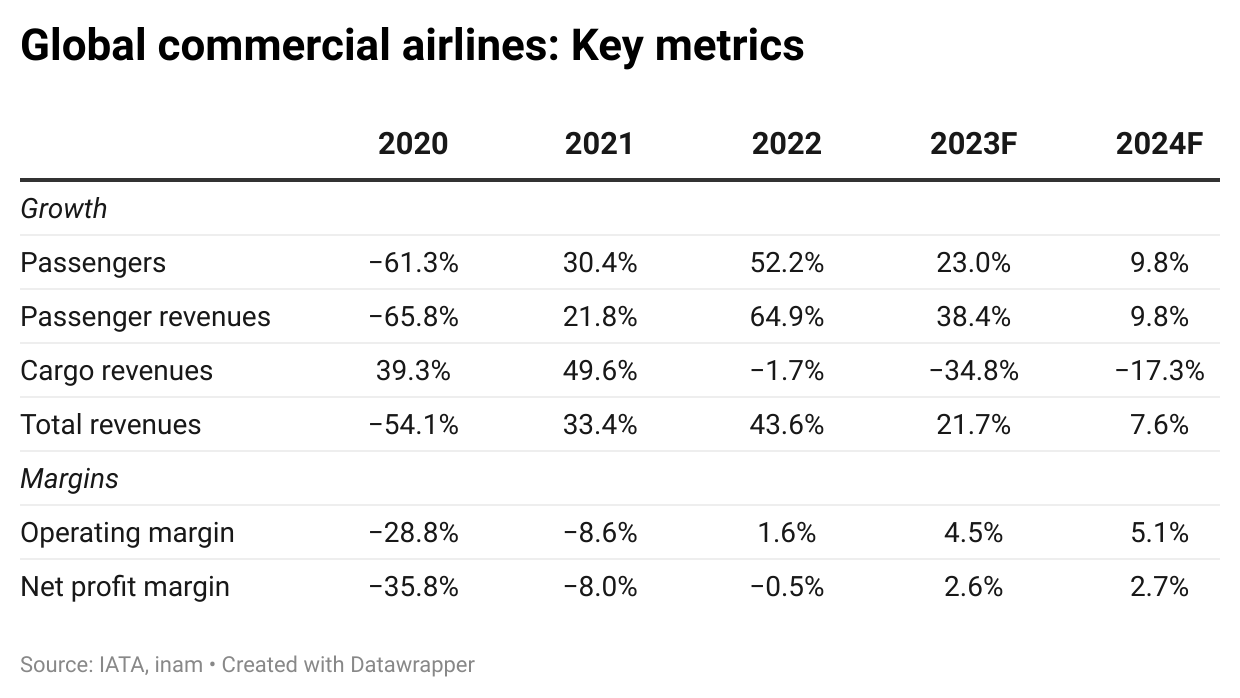

Press reports indicate moves are afoot to prepare Abu Dhabi-headquartered Etihad Airways for a US$1bn IPO before year-end, suggesting the Middle East will remain a global hotspot for new issuances. The news comes after Etihad’s 2023 results, which pointed to strong volume growth, higher margins and reduced gearing. This mirrors the strong recovery in the airline industry’s performance last year, with Asia-Pacific airlines bouncing back particularly strongly.

The global airline industry is in an upswing

According to trade body IATA, industry metrics will improve further this year. Passenger traffic could grow by 10% this year (once again driven by Asia-Pacific), with operating margins widening 60bps and industry profits rising 10%. In Q1 24, industry passenger revenues grew almost 17% yoy.

Emirates is the largest regional operator

Despite its strong growth, Etihad remains smaller than its local neighbours, Emirates and Qatar Airways. A successful IPO could also open the doors for these larger entities to list.

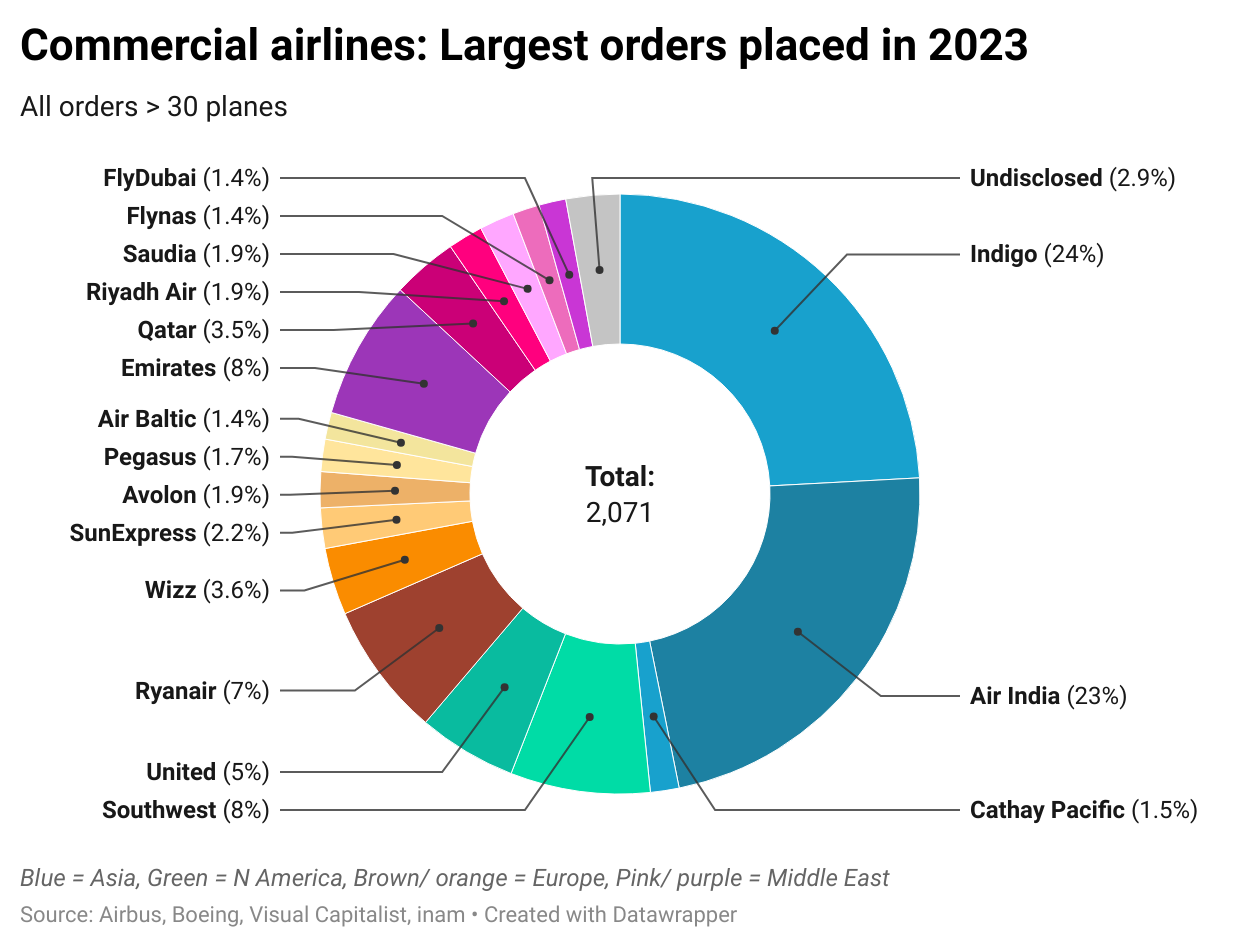

India is likely to increase in importance

India is already a key market for UAE airlines; Indians represent the largest expatriate group in the country. But a lack of capacity from Indian operators is holding back traffic. With Air India and Indigo placing massive aircraft orders with Airbus and Boeing last year, UAE airlines should benefit from reciprocal arrangements that give them more landing slots on the subcontinent.

Sheikh Zayed International Airport is an attractive hub

Abu Dhabi recently opened Terminal A, which has a capacity of 45mn passengers per year (versus 15.5mn airport capacity in 2022), with scope for this to be increased to 60mn in the future. This facility can therefore support Etihad’s growth ambitions for many years.

Valuation discussions will continue to be refined

Press reports indicate the timing of any IPO transaction for Etihad Airways has yet to be finalised. Discussions around pricing will likely be a key factor in the go/ no-go decision. Press reports point to a US$1bn transaction size but have not clarified the overall valuation.

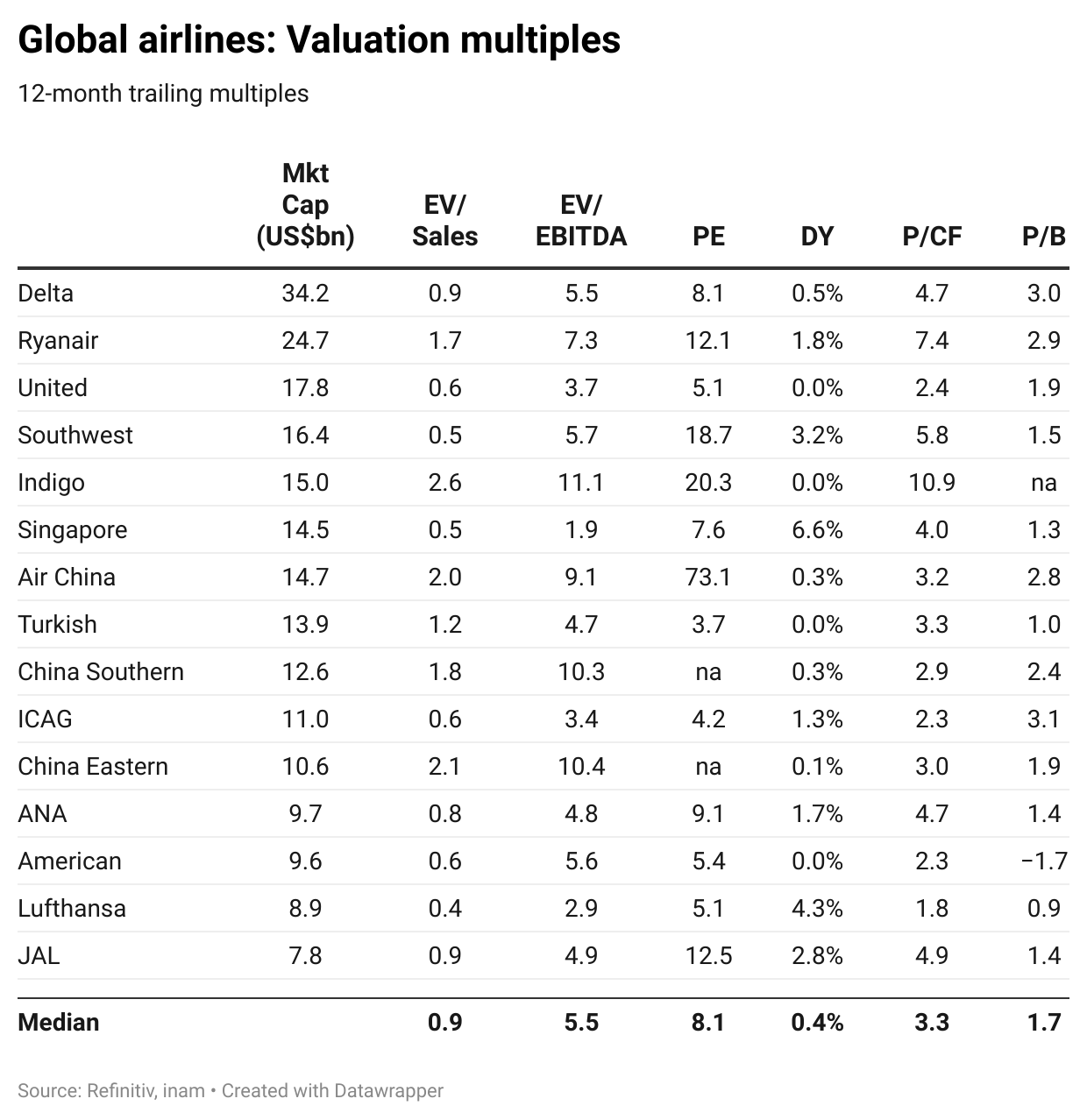

We highlight below the valuation multiples at which some global peers trade. Advisors are likely to highlight Etihad’s exposure to growing demand, both in the Middle East and Asia-Pacific, allied to its ability to secure low-cost financing to fund investment.

As well as steering investors towards higher-multiples Asian peers, the company’s advisors are also likely to encourage investors to use revenue-based metrics that generate a higher valuation for the business, or to project higher margins in future periods based on expectations of higher volumes.